Fynance is a company that aims to bridge the gap in business-to-business invoice payments, where suppliers' credit terms are becoming shorter, and customer payments are being pushed further out. The company recognizes that small and medium-sized businesses struggle to obtain credit lines from banks, and even if they do, processing times can be lengthy, causing a delay in payments. Fynance's mission is to increase margins for its clients by allowing them to negotiate discounts with their suppliers, thereby providing capital upfront for every entity in the supply chain whose margins are already low to start with. The company's long-term vision is spread out over four phases, with each phase adding more functionalities to its plan.

In phase one, Fynance empowers small and medium-sized enterprises with liquidity to sustain a healthy cash flow using their Pay Later for Business and Pay Later for Suppliers platforms.

In phase two, Fynance partners with AntChain to build a supply chain infrastructure for small businesses to enter the Chinese market using established online platforms such as Taobao and T Mall.

In phase three, Fynance adds a strong suite of supply chain partners in manufacturing, marketing, and sales, available for small businesses to pivot from.

Finally, in phase four, Fynance works closely with several Venture Capital firms to routinely raise capital, invest, and further nurture businesses that show strong potential.

Fynance is committed to helping small and medium-sized businesses thrive in an increasingly competitive market by providing innovative solutions to their financing needs.

Fynance is a company that provides financial solutions to small and medium-sized enterprises (SMEs). It offers four financial products to its clients as below:

1. Pay Later for Business

Pay Later for Business is an SME invoice financing product that provides revolving credit for customers. This means that SMEs can get early payment on their invoices, which improves their cash flow and enables them to manage their business better. The product is designed to help SMEs bridge the gap in B2B invoice payments, where suppliers' credit terms are becoming shorter, and customer payments are being pushed further out. This product is an excellent option for SMEs that need quick access to working capital.

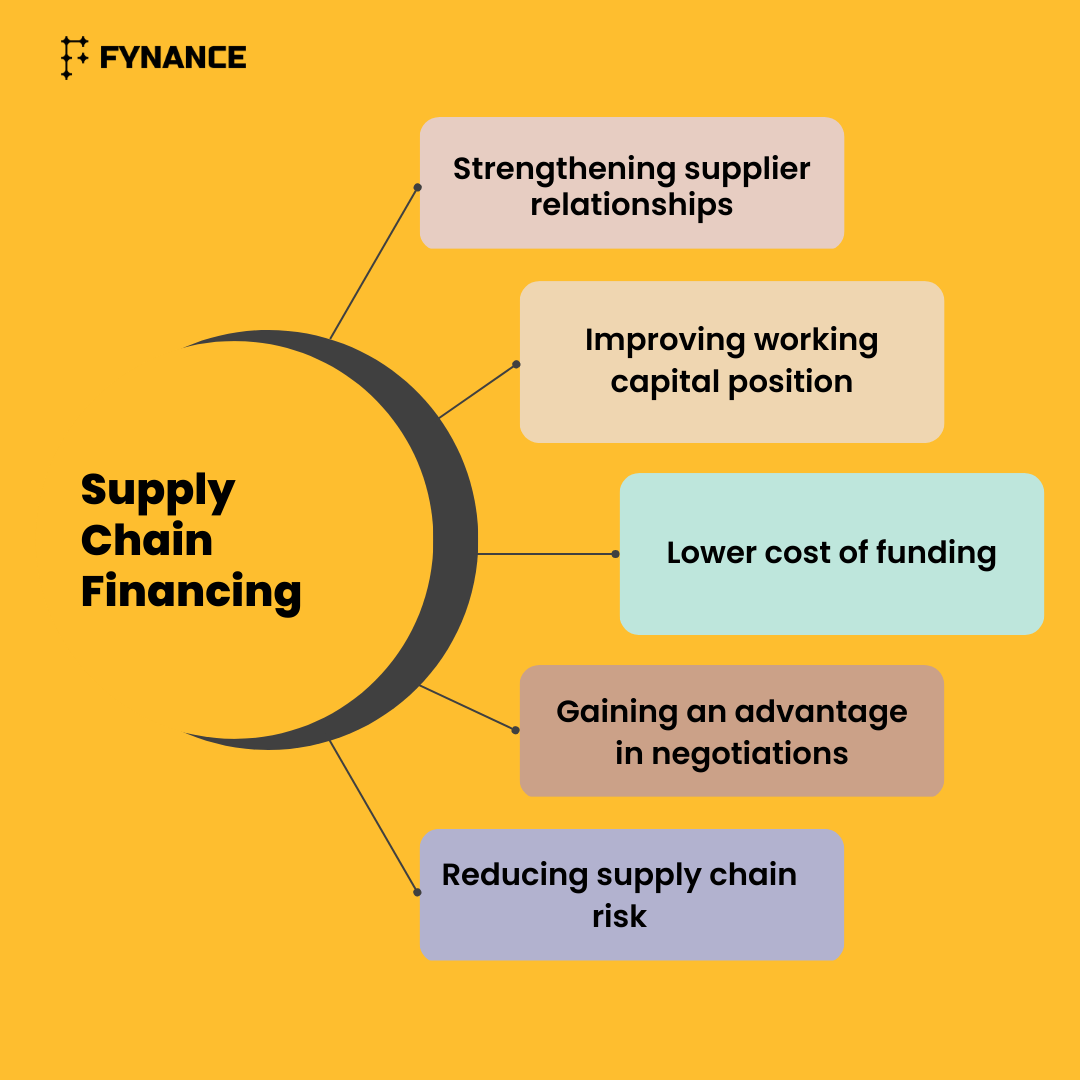

2. Supply Chain Financing for Customers

Supply Chain Financing for Customers is an SME reverse factoring product that provides fast and convenient financing for suppliers' customers. The product enables suppliers to get paid earlier by their customers while still allowing customers to pay on their usual payment terms. This way, suppliers can improve their cash flow, reduce their borrowing costs, and enhance their relationships with their customers. The product has a limit of up to RM 3 million per customer, making it an excellent option for SMEs that need to finance their supply chain.

3. Capital Financing

Capital Financing is a term loan product that provides financing for SMEs for up to 12 months with a limit of RM 1 million. The product is designed to help SMEs fund their working capital needs, such as inventory purchases, payroll, and other expenses. The loan is typically repaid in fixed instalments over the loan term, making it easier for SMEs to manage their cash flow.

4. Project Financing

Project Financing is a structured finance product that provides financing for large-scale projects, such as asset financing and large entertainment events. The product is designed to help companies finance these projects while mitigating risks and maximizing returns. The product's documentation is based on the project, and the company works closely with the client to understand their needs and develop a financing solution that meets their requirements. This product is an excellent option for companies that need to finance large-scale projects and want to work with a company with extensive experience in this area.

The four financial products offered by Fynance are designed to address specific challenges that SMEs face when managing their finances. Below are some of the ways these products help SMEs solve their problems and issues:

Pay Later for Business: SMEs often face cash flow issues due to delays in receiving payments from their customers. This product provides revolving credit for customers, allowing SMEs to receive financing against their outstanding invoices. This helps SMEs manage their cash flow and improve their working capital position.

Supply Chain Financing for Customers: SMEs that supply goods and services to larger companies often have to wait for extended periods to receive payments. This product provides fast and convenient financing for suppliers' customers, allowing SMEs to receive payment sooner and improve their cash flow position.

Capital Financing: Many SMEs struggle to access financing due to their size or lack of collateral. This product provides term loans of up to 12 months with a limit of RM 1 million, allowing SMEs to access financing for their business needs.

Project Financing: SMEs often face difficulties in obtaining financing for large-scale projects. This product provides structured finance products that can help SMEs finance large projects, from asset financing to entertainment events.

Fynance empowers SMEs in several ways:

Access to Financing: Fynance provides SMEs with access to financing that they may not be able to obtain through traditional sources, such as banks or other financial institutions. By offering a range of financing products, including Pay Later for Business, Supply Chain Financing, Capital Financing, and Project Financing, Fynance helps SMEs to manage their cash flow, invest in their businesses, and pursue growth opportunities.

Customized Financing Solutions: Fynance offers customized financing solutions tailored to the unique needs of each SME. This approach allows SMEs to obtain financing that is appropriate for their business, helping them to achieve their goals and grow their businesses.

Simplified Financing Process: Fynance has developed a streamlined financing process that is designed to be fast, convenient, and transparent. SMEs can apply for financing online, and the approval process is typically quick and straightforward.

Strategic Partnerships: Fynance has established strategic partnerships with a range of supply chain partners, manufacturing, marketing, and sales partners. These partnerships enable SMEs to access a broader range of services and resources, helping them to grow their businesses more effectively.

In conclusion, Fynance is a financial technology company that provides SMEs with access to financing and customized financing solutions. Fynance helps SMEs to overcome financing challenges and pursue growth opportunities, which in turn helps to build a more vibrant and dynamic SME sector. By establishing strategic partnerships with a range of supply chain partners, manufacturing, marketing, and sales partners, Fynance can offer SMEs a broad range of services and resources, enabling them to grow their businesses more effectively. With a streamlined financing process that is fast, convenient, and transparent, Fynance is making it easier for SMEs to obtain the financing they need to succeed in today's competitive business environment. > Click to Apply for Financing