What is Supply Chain Financing (SCF)?

Unlike invoice factoring, invoice factoring is a type of small business loan that businesses can use to get money on outstanding invoices immediately. They work with a third-party lender that will buy exceptional accounts receivable.

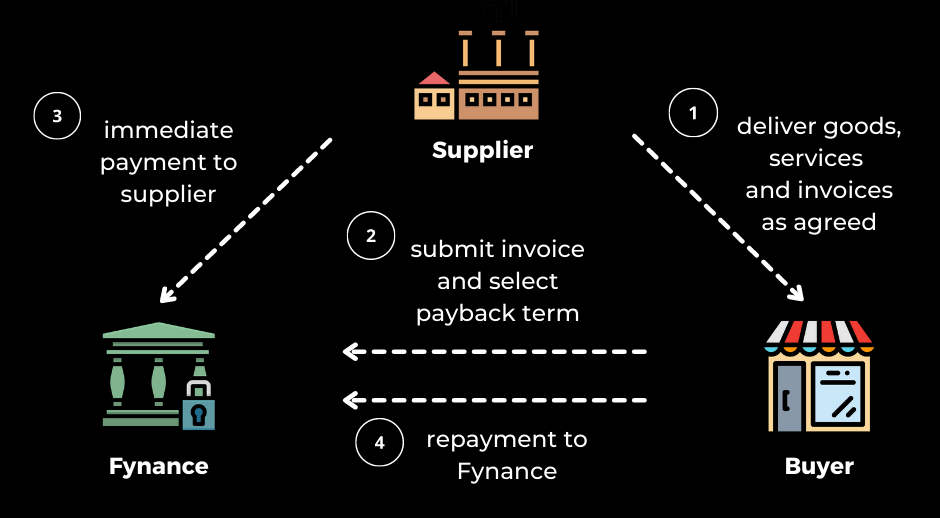

Supply Chain Finance (SCF) is a financing solution initiated by the buyer where the buyer agrees to pay an invoice early for a discount. The benefit to the buyer is a discount on the invoice price. Suppliers can receive advanced payment on the outstanding invoices from a third-party funder. SCF allows businesses to extend payment dates to suppliers without any impact on their credit scores and without the suppliers losing money.

To be clear, SCF is not a loan or debt – it is a tool that small businesses and suppliers can use to free up capital via a third-party funder. At the same time, third-party funding institutions may charge a fee for each transaction. SCF is not an asset-based lending program.

Small businesses that need to finance invoices will benefit from Fynance. Fynance is a TRUSTED SCF SERVICE PROVIDER with no collateral financing, and no hidden fees and offers clients repayment options. The company also provides short-term credit solutions, such as the Pay Later credit line, to micro, small and medium enterprises (MSMEs) facing capital issues. The Fynance platform helps buyers and suppliers optimize their working capital and access low-cost funding options. The company closely works with various financial institutions to provide lending services to businesses.

About the Company (Fynance)

Fynance is a recently launched supply chain financing company with the vision to help small to medium businesses grow their companies (SMEs) through their innovative way of providing cash flow. Maintaining a healthy cash flow is one of the top challenges for small and growing businesses in Malaysia. Companies juggle cash from customers to pay for stock, employees, and expenses. In many cases, money from profits is insufficient to reinvest and grow the businesses further while settling outstanding payments. Fynance is committed to resolving challenges through its innovative technology platform based on cloud computing, blockchain, and other advanced technologies.

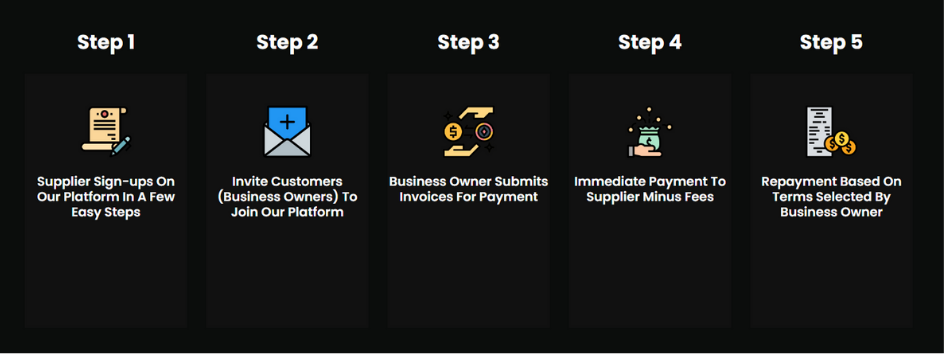

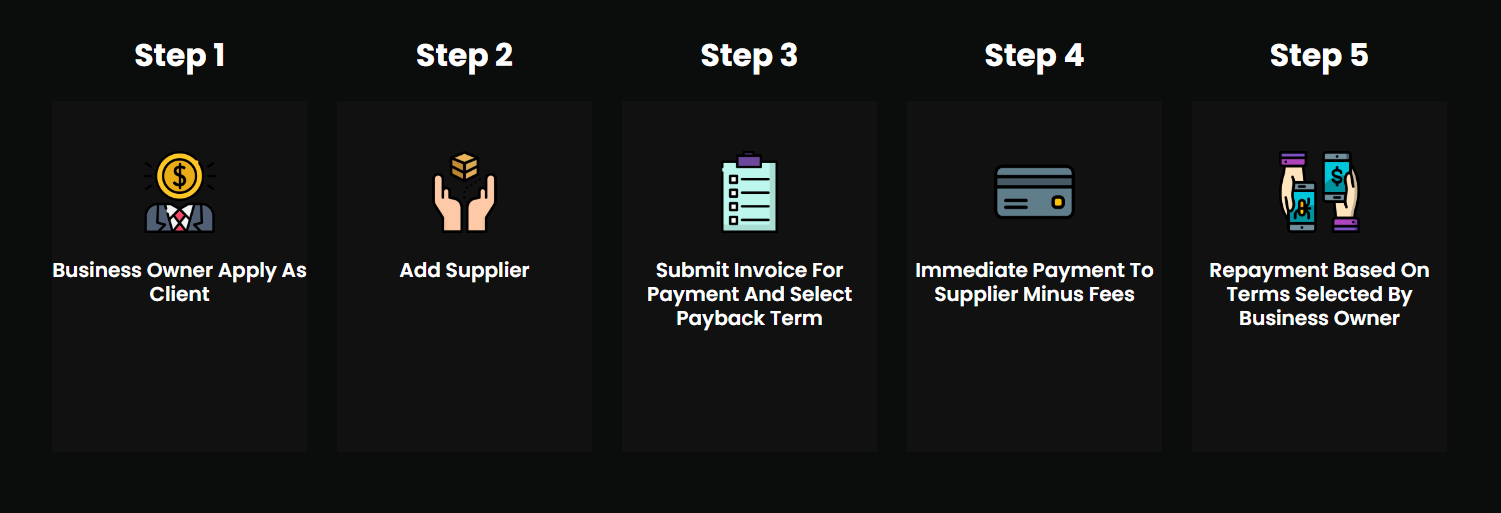

How does SCF (PayLater Service) Work?

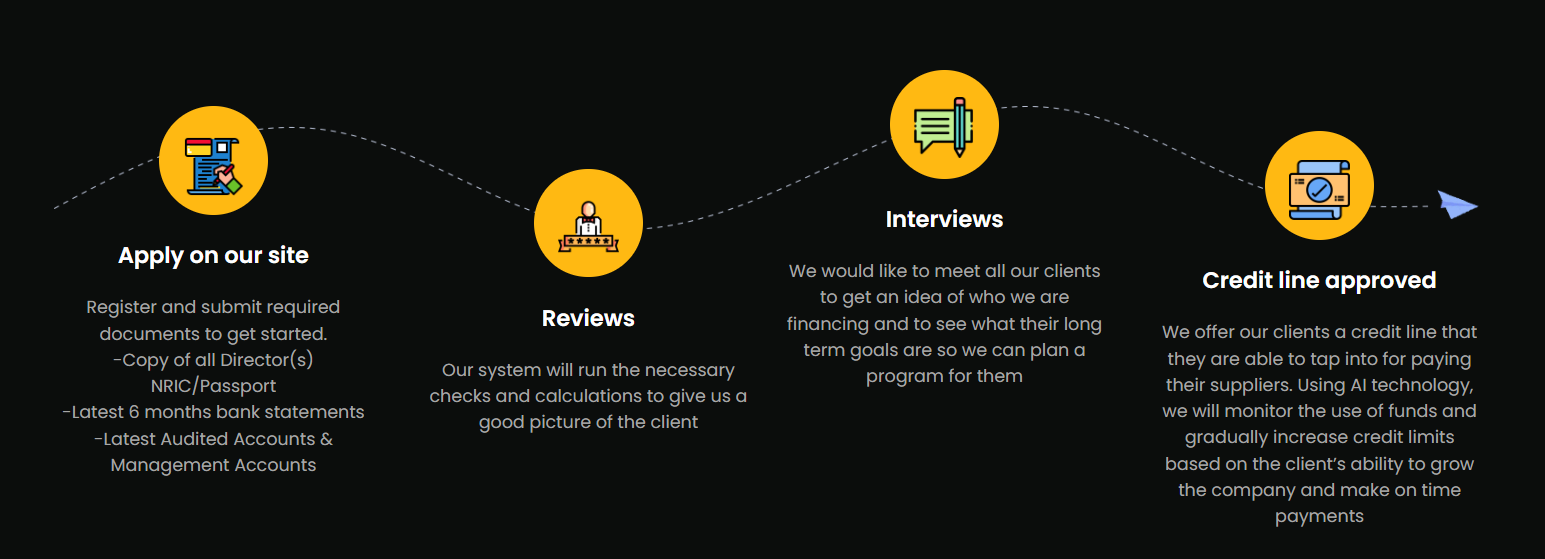

The Application Process

The Application Process

1. Apply on fynance.io

2. Reviews

Once the applicant has submitted the required documents, the Fynance system will run the necessary checks and calculations to give them a good picture of the client or supplier.3. Interviews

Fynance would like to meet with all their clients to get an idea of what they are refinancing and see their long-term goa.s to plan a program for them.

4. Credit line approved

Fynance offers their client a credit line that the clients can tap into for paying their suppliers. Using AI technology, Fynance will monitor the use of funds and gradually increase credit limits based on the client's ability to grow the company and make on-time payments.

Fynance PayLater for Business (click here to sign up)

To apply for the PayLater financing, businesses need to sign up on Fynance platform via fynance.io and upload some financial documentation and company details.