Traditional banks usually provide online banking choices such as a banking website or a mobile app for you to perform your transactions. An extensive ATM network is essential in the twenty-first century. Because conventional banks have bank branches, so they will also provide ATM access through their network. Furthermore, a regular bank's checking account generally comes with years of fees. In-person customer care is where conventional banks have an advantage. After all, staffing bank offices with welcoming faces is part of the overhead that keeps them charging more.

SCF often covers various supplier financing options, such as dynamic discounting. The buyer pays for the program by allowing suppliers to access early payment on invoices in exchange for a payment discount. The phrase is, however, more generally used as a synonym for reverse factoring.

In the first case, the purchaser will sign a deal with a supply chain financing provider and afterward encourage its vendors to participate in the program. Some supply chain finance projects are supported by a single issued by a financial source, while technology professionals manage others on an inter basis via a dedicated platform. While buyers have traditionally focused on onboarding their 20 or 50 most significant suppliers, technology-led solutions now enable companies to offer supply chain finance to hundreds, thousands, or even tens of thousands of suppliers. This is made possible by providing user-friendly platforms and streamlined supplier onboarding processes, making it simple to large onboard numbers of suppliers rapidly and with minimal effort. Once a supply chain finance program is up, suppliers can request early payment on their invoices. From there, the supply chain finance process plays out, which typically looks something like this:

- The buyer obtains products or services from the supplier.

- The supplier sends the buyer an invoice, with payment due within a particular number of days (30 days, 60 days, or 90 days).

- The invoice is approved for payment by the buyer.

- The supplier demands that the invoice be paid as soon as possible.

- The funder pays money to the provider after deducting a nominal charge.

- On the due date of the invoice, the buyer pays the funder.

This involves a third party - the financer or lender - who will instantly pay the invoice on the buyer's behalf and then prolong the repayment schedule under which the buyer must pay them back, maybe to 60 days. This is a win for all parties: the purchaser gets to keep their working capital for longer without jeopardizing their relationship with the supplier. The supplier gets paid instantly, giving them more working money to spend. There are several more advantages.

Suppliers and buyers can benefit from supply chain finance in many ways:

Benefits for suppliers are optimizing working capital, access to lower-cost funding, and improved cash forecasting accuracy.

By accessing supply chain finance, suppliers can receive payment for their invoices earlier than they would otherwise. As a result, their day's sales outstanding (DSO) is reduced, resulting in working capital improvements.

The cost of funding is usually lower for suppliers if they use other funding sources, such as factoring, making supply chain finance an attractive way of obtaining funding. When suppliers access supply chain finance, they may gain more certainty over the timing of incoming payments, making it easier to forecast their future cash flows accurately.

Benefits for buyers are improved working capital, the supply chain's overall health, and supplier connections.

Buyers can also enhance their working capital position using supply chain finance, as many organizations adopt supply chain finance programmed in tandem with supplier payment terms harmonization push.

After that, buyers can lessen the possibility of future supply chain disruptions affecting their operations by giving suppliers supply chain credit. And also, buyers may strengthen their ties with suppliers by providing them with low-cost capital, and as a result, they may be in a better negotiation position.

Flexible funding

While supply chain finance and dynamic discounting are different solutions, some companies may wish to access both types of programs. For example, some businesses will have surplus cash available at certain times of the year, which can be deployed in a dynamic discounting program – but at other times of the year, they may wish to invest the cash elsewhere.

One option is to implement two different financing solutions from other vendors – but this may be less than ideal regarding the supplier experience. Alternatively, vendors that offer a flexible funding model may allow buyers to switch seamlessly between the two models as the need arises.

Trade and supply chain financing provide creative solutions to many expanding businesses' working cash gap. They may help firms realize their full potential by increasing cash flows, providing funding, shortening the end-to-end trade cycle, boosting financial ratios, and avoiding counterparty and other risks in cross-border transactions. What distinction between conventional commerce and supply chain finance?

Trade finance is divided into two major categories, both of which address the competing interests of buyers and sellers: conventional or documented trade and supply chain financing. Traditional or documentary trade has existed for centuries, with banks serving as mediators to allow the exchange of cash for shipping documentation. This is known as transaction/shipment-based financing, risk mitigation, and payment for underlying buyer-seller transactions. Supply chain finance, on either hand, is a circulation financing strategy in which banks have a minor role in the operations. The funding is based on agreements, claims, and guarantees between the total transaction participants.

Transactions structures will primarily focus on the listing agent or supplier's entitlement to receive payments on an open account. Risk mitigation is also a characteristic of these transactions, which is accomplished by installing various safeguards, including risk-sharing, transfer of risk, or the inclusion of 3rd parties in the transaction circulation structure. Typically, customers will exchange transaction data with banks to receive funding, which will be done in bulk depending on the data. An estimated 90% of trade transactions are settled on bank-to-bank terms, allowing supply chain financing to expand.

How can traditional trade and supply chain financing help with working capital?

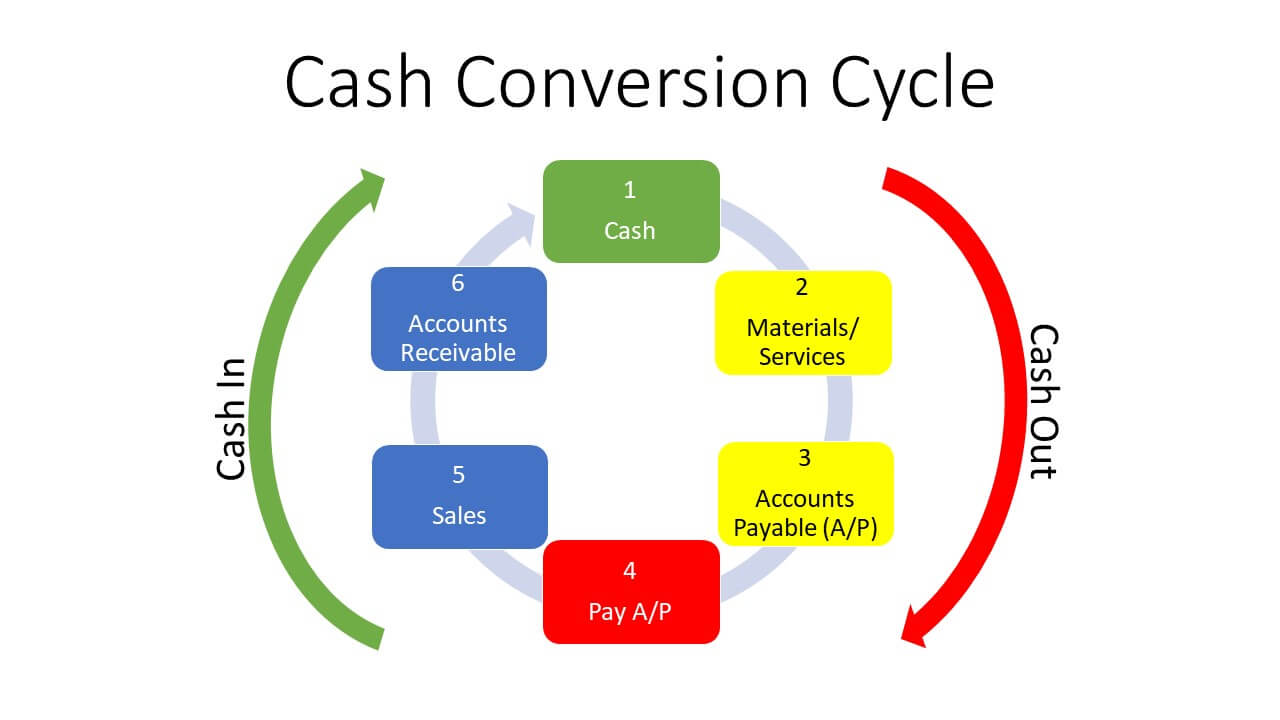

Understanding the working capital gap (CCC) and identifying competitive financing solutions (such as raising payment days or decreasing lead times, inventory days, and receivable days) is critical for every firm today. CCC begins with cash and concludes with money. Showing a steady depicts the cash conversion cycle for each organization; nevertheless, not all companies have had all components of a CCC.

Image 1 - Cash Conversion

The cash conversion cycle shown above can be illustrated in another form to understand the role of trade and supply chain finance.

Figure 1.2 illustrates the trade cycle transposed.

Cash—> Lead Time—> Payables —> Inventory —> Receivables —> Cash

Chart 1

As shown in chart 1, a trade business will pay cash to their suppliers, and go through lead time, inventory, and receivable phases to receive some money from the customers. The length of the trade cycle will depend on the total number of days the business will take for each component/phase. Therefore, reducing the process and increasing the turnover will grow any business. Conventional cross-border supply chain finance products are depicted in each stage of the trade cycle. Traditional trade and supply chain finance products and solutions will emphasize:

- Finance

- Increased payable days (DPO)

- Reduced lead time

- Reduced inventory days (DIO)

- Reduced receivable days (DSO)

- Risk mitigation

- Improve balance sheet ratios, and

- Collection of payments

All solutions seek to unleash potential and shorten the time it takes from capital to cash. As a result, trade and supply chain solutions may be referred to as products for speeding cash flows for business growth.

What motivates traditional trade and supply chain finance?

Drivers for banks

Control of items deemed collateral via shipping papers - The majority of traditional commerce products require shipping documents to be routed through banks. As a result, the underlying goods/documents serve as collateral for any transaction financing. In the unusual event of a default, banks will be able to sell the linked items and recoup their cash. This is not a characteristic of supply chain financing transactions.

Many conventional commerce items need bank transactions via MT202. Bank-to-bank payments will be made, allowing banks to keep adequate control over the settlements. If a bank has supplied finance, the money will be used to repay the linked finance, and clients will be unable to utilize the payment for any other purpose since it will not be credited to their account. This may or may not be an option in supply chain transactions. Some banks, however, may attempt to preserve the same level of control by using restricted account for financial management payments.

In conventional commerce transactions, banks have the advantage of comprehending shipping paperwork. This guarantees that the papers' information is reviewed for AML and sanction problems. When compared to funding clients through supply chain finance or OD/Loan products offered by banks, conventional commerce is far less dangerous from an AML/sanction standpoint.

Supply chain finance is data-driven financing that is matched with the data transferred between stakeholders. As a result, supply chain finance data interchange and financing may be totally automated. As a consequence, compared to traditional trade finance, supply chain transactions may be managed with less employees and resources. This will lower the cost and time required for supply chain transactions.

Banks earn fees from traditional trading transactions. This is a big draw for financial institutions since they don't have to utilize their money to participate in this company. If, on the other hand, money is utilized for financing, the profitability of the financing will be boosted due to transaction-based fee income. Supply chain finance, in comparison, may generate less service charge revenue and is mostly viewed as interest earned obtained via financing.

Drivers for clients (Buyers/Suppliers)

Banks are required to offer services such as issuing LCs, advising LCs, sending/receiving papers, examining documents, effecting and collecting payments in traditional trade financing. The services will contain prices. As a result, as compared to supply chain transactions, this may be regarded as costly.

ICC publications such as UCP600, URC522, ISP98, URDG758, ISBP, and others manage the conventional trade financing procedure. As a result, this may be difficult for new clients who lack expertise in this position. Furthermore, in other cases, these procedures may be less adaptable. Hiring workers with trading experience will also be difficult because most relevant experience is distributed among institutions. Because traditional commerce is a specialty, acquiring trade specialists from other organizations will be perceived as a significant problem. Supply chain financing transactions are considerably easier to understand and culture than typical commerce transactions.

Many conventional trade items may need extensive scrutiny before being financed or paid by the financier or counterparty institutions. As a result, it may take a long time for consumers to get financing and receive payments. When it comes to supply chain finance, you might argue that it will require less time to accept funds.

Drivers for Fintech

Disruptive technology is a driving force in Fintech. The banking industry is experiencing significant digital change, and customers' expectations are growing. FinTech is helping the financial sector in meeting demand. In the role of supply chain finance, the banking industry has been technologically more prosperous than conventional trade finance. Furthermore, because supply chain finance is flow-based and financing is dependent on data shared between multiple parties participating in the transaction, it may be claimed that it is simpler to digitize. Furthermore, improved advances in the supply chain space are available.

However, the conventional commerce sector is entering a period in which players attempt to feel at ease with the digital solutions provided by various FinTech firms. Because traditional commerce involves manual paperwork, digitizing documents and releasing or transferring them electronically are significant issues for the existing trade arena. While adding value to the banking industry, some Fintechs are service charges and may be controlled by FinTech. The users, primarily corporations, may have to pay fees to the bank.

Thus, traditional trade and supply chain financing solutions may fund every customer's business cycle step. Historically, product innovation has assisted customers in significantly growing their business. There are several reasons for banks, customers, and FinTechs to select between the two streams.

With the impacts of Covid19 and a mild V-shaped rebound, trade flows are expected to reach USD27 trillion in 2028. According to the ICC Banking Commission, 90 percent of commercial transactions are resolved on open account terms. However, because of the current COVID-19 crisis, conventional trade is expected to expand quickly. Historical data and trends indicate that supply chain financing will develop during the next decade. Traditional trade financing may become more competitive in the future as a result of digital disruption. Nonetheless, it is up to the sector to adopt the digital solutions proposed by many stakeholders to compete with supply chain financing.